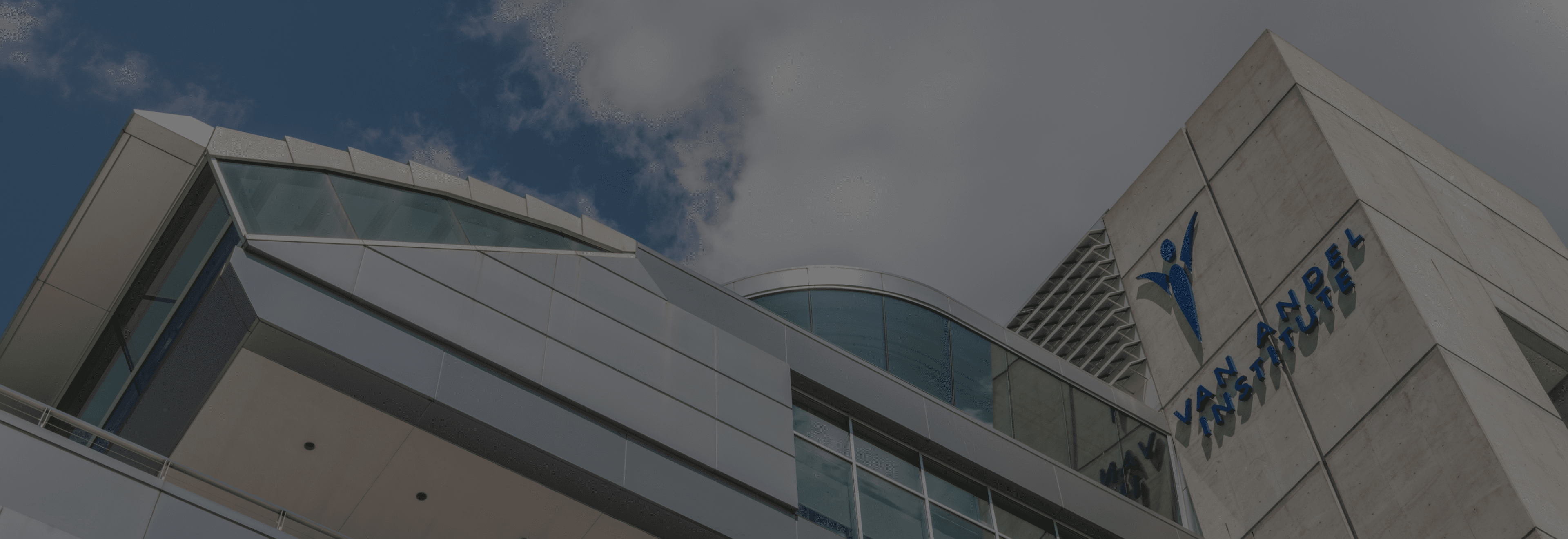

Ways to Give

We’re raising thousands to help millions.

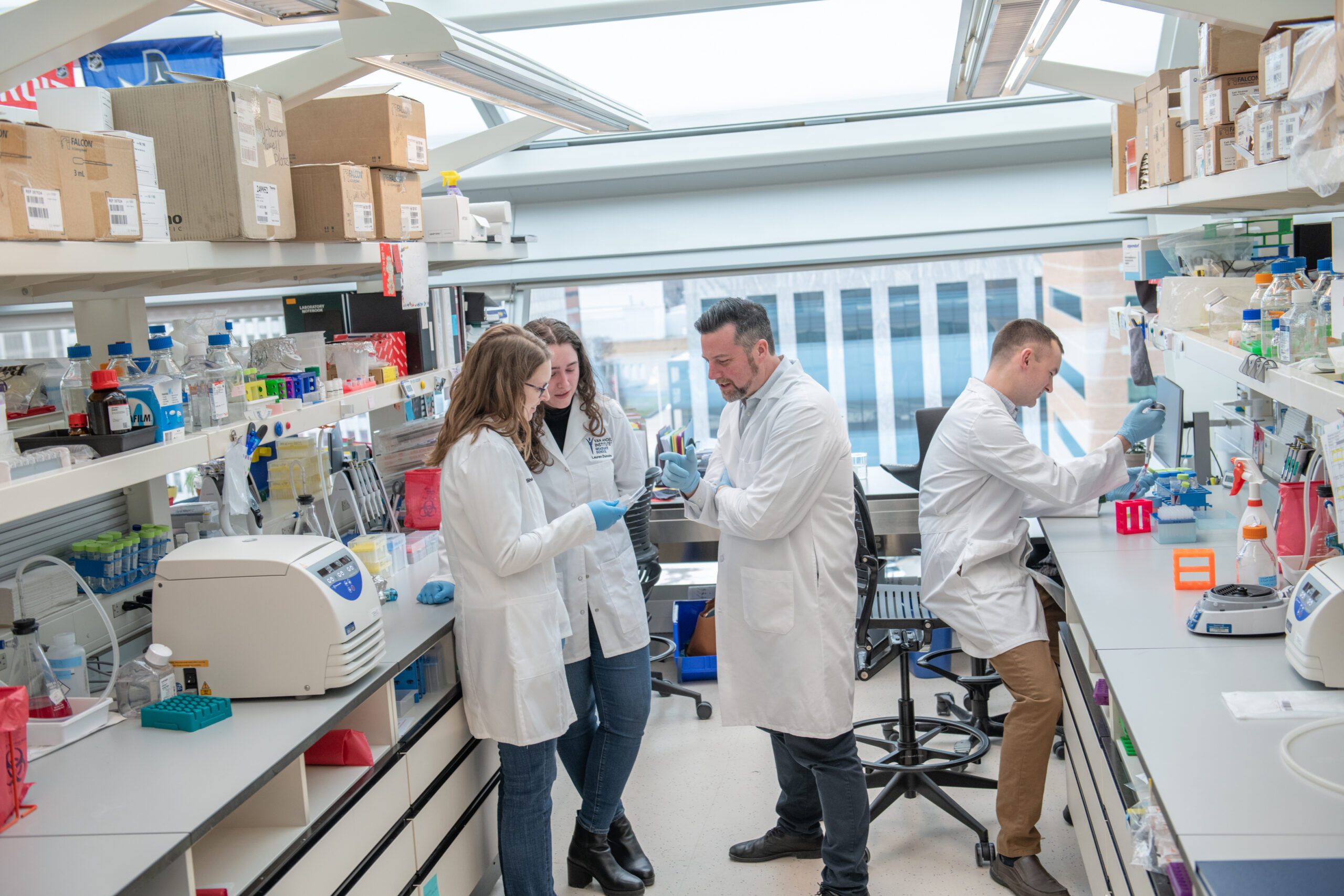

At Van Andel Institute, we’re turning hope into action for the millions of people around the world affected by diseases like cancer and Parkinson’s.

Every donation to Van Andel Institute goes directly to biomedical research into these diseases and their causes. Every gift supports K–12 and science education. And every dollar brings us one step closer to understanding diseases like cancer, Parkinson’s and more — and one step closer to saving lives.

Whatever your reasons for donating to Van Andel Institute — to bolster exploration of the biological origins of disease, to support innovative educational approaches, or to memorialize a loved one affected by disease — your support is essential to our mission. So please consider a gift today for what may be invaluable for humanity tomorrow.

Cash Gifts and Pledges

Cash gifts can be made online or mailed to VAI in support of our research and education. For multi-year pledges, please contact a member of our Philanthropy team for more information on how your gift can have the greatest impact on our research and education.

Give a GiftImpact Monthly Giving Club

Help sustain VAI’s research and education programs all year with an automatic monthly payment made through our secure online system. A monthly donation can make a lasting impact in our labs and Graduate School classrooms, and help us remain a leader in inquiry-based K–12 education.

Impact Monthly GivingPlanned Giving

Make a lasting investment in the future of research and science education by including VAI in your estate plans. Choose from a variety of estate giving options while supporting a cause that is meaningful to you and has an impact on so many others.

Planned GivingGift of Stock

Donating appreciated securities, including stocks, is an easy and tax-effective way for you to make a gift to the Institute. Contributions of appreciated securities held for over a year are generally deductible at market value, regardless of what the donor paid for them.

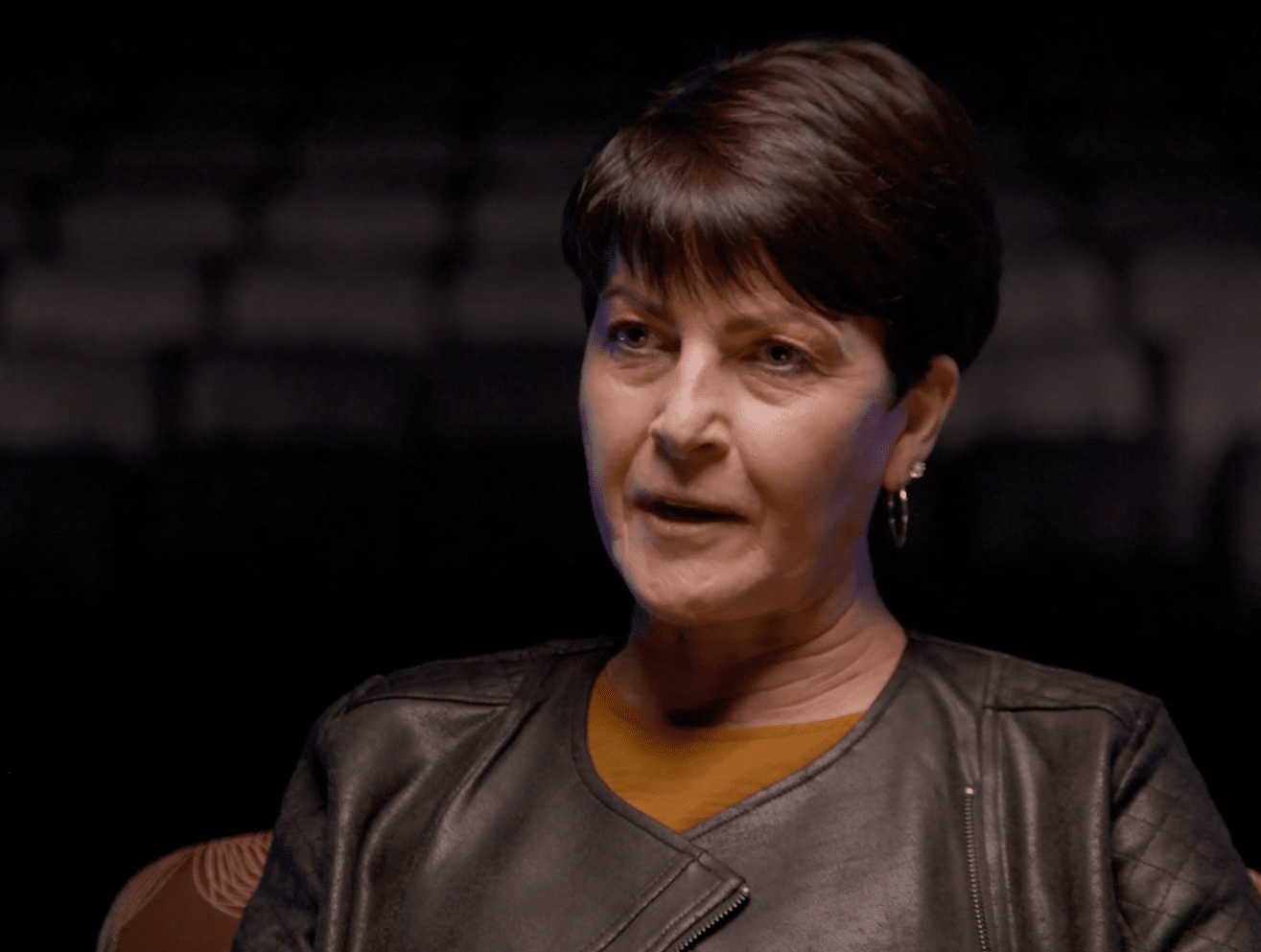

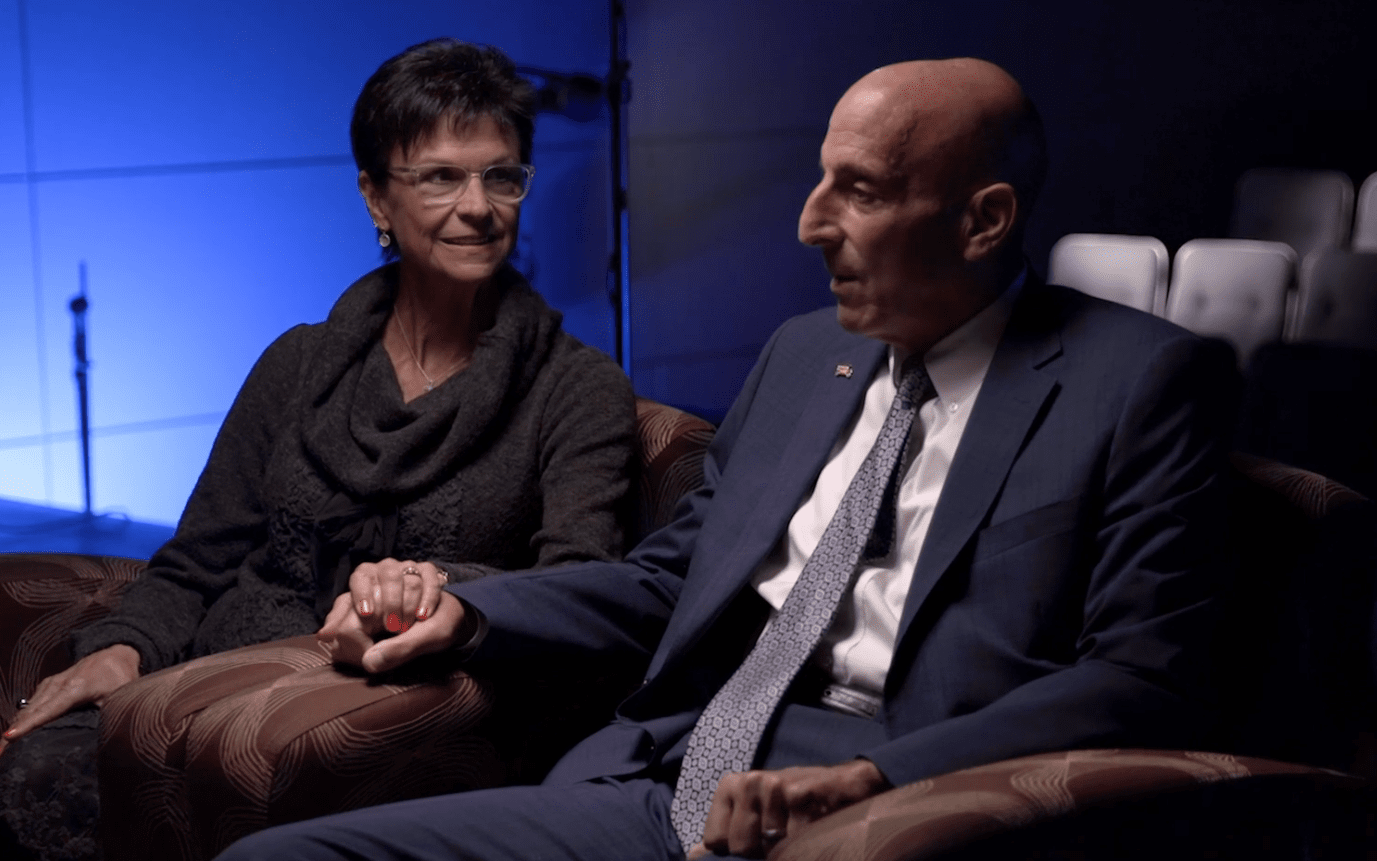

Gift of StockMemorial and Tribute Funds

Make a gift to VAI or create a memorial or tribute fund in honor of a cherished loved one. Those honored through this type of donation are featured on our website and in our biannual donor publication, Highlights of Hope.

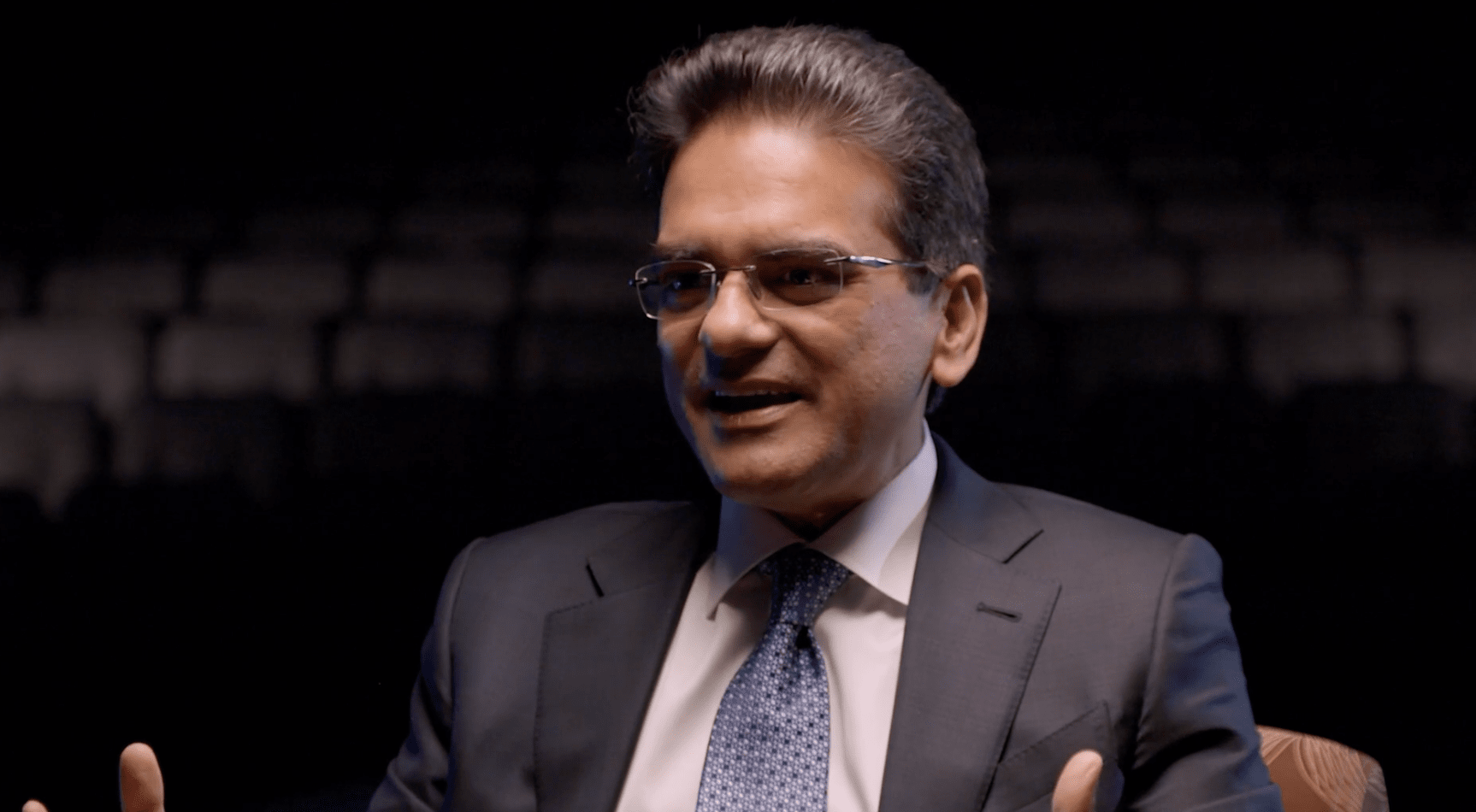

Memorials and TributesCorporate Partnership Program

Make a commitment to our mission by supporting special events throughout the year, engaging your staff in joining our committees and encouraging employees to volunteer with the Institute.

Corporate PartnershipsWays to give

Your support of Van Andel Institute brings hope to millions of people with diseases like cancer and Parkinson’s, as well as students and teachers around the world.

DonateWays to Give

Give safely and securely with a credit card donation. Gifts can be made easily and quickly online, are tax deductible and support research and education at Van Andel Institute.

Give safely and securely with a check. Gifts can be made easily and quickly, are tax deductible and support research and education at Van Andel Institute.

Checks should be made out to Van Andel Institute and mailed to:

Van Andel Institute

Attn: Philanthropy

333 Bostwick Ave. NE

Grand Rapids, MI 49503

Your gift via wire transfer is tax deductible. Gifts support research and education at Van Andel Institute. Contact us at [email protected] or call us at 616-234-5040 for more information.

Donating appreciated securities, including stocks, bonds, and mutual funds is an easy and tax-effective way for you to make a gift to Van Andel Institute. Click here for more information.

Use your Donor Advised Fund (DAF) to distribute gifts to numerous charities, including Van Andel Institute. With a DAF, you can make gifts to charity during your lifetime, and when you pass away, your children can carry on your legacy of giving. Click here for more information.

If you are 70.5 or older, an IRA charitable rollover is a way you can help continue research and education efforts at Van Andel Institute. Click here for more information.

Every dollar of every donation goes to biomedical research

One hundred percent of your gift directly supports VAI’s research and education programs. Help make a difference today!